As the name infers, a demand letter is used when the sender has to take something from the recipient. It is written officially to claim the restoration of some overdue benefits from the recipients. Those claims could be of the money, response on a legal matter, or an action in some legal case.

It is written when the recipient isn’t responding to the official notices of the sender. It is considered as the last notice before the sender takes legal action against the recipient. It acts as solid evidence in a lawsuit if the recipient doesn’t cooperate.

What Are the Different Types of Demand Letters?

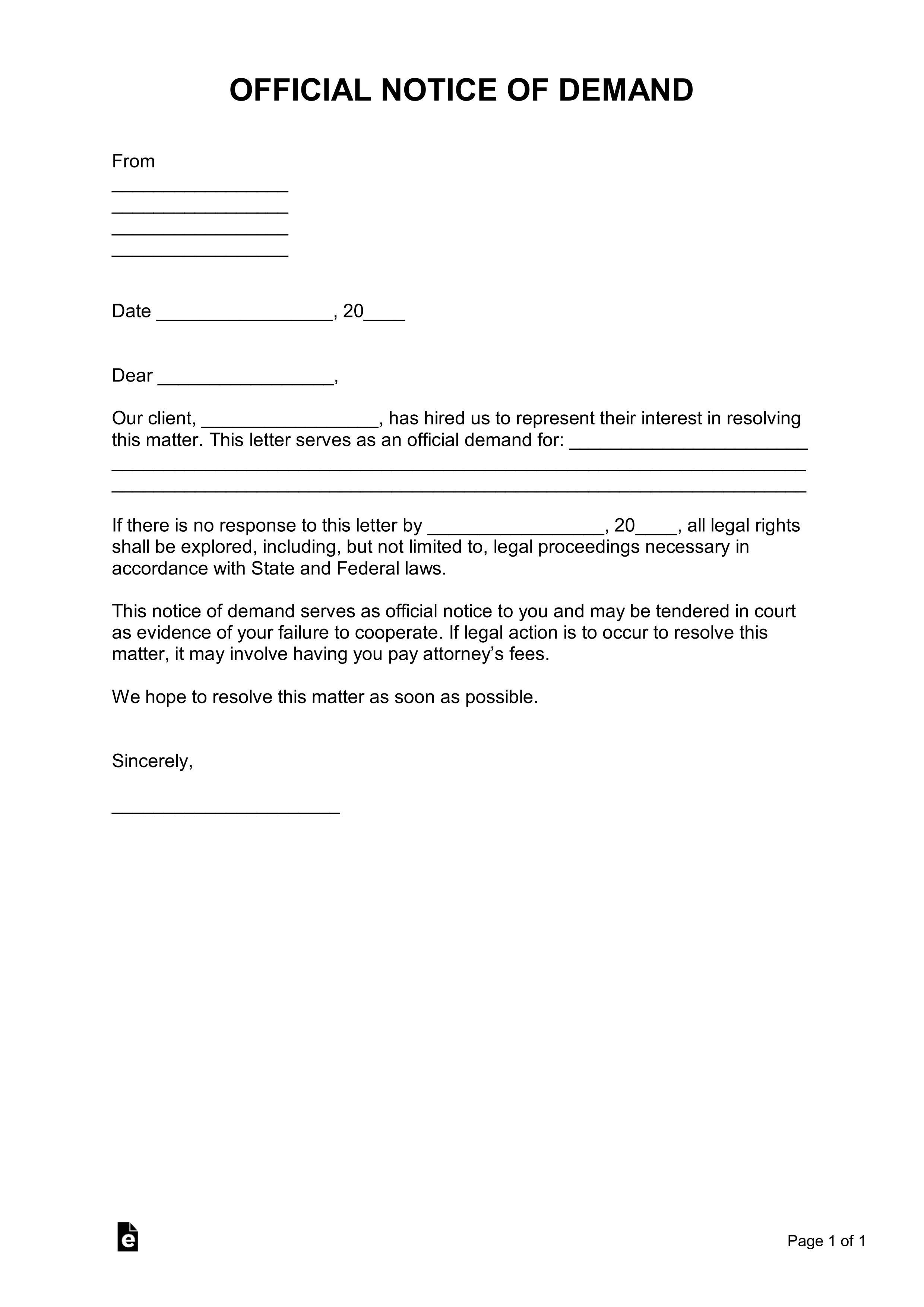

A demand letter can be written for different purposes. It’s good to use a demand letter from an attorney to take legal advice. Some types of demand letters are as follows:

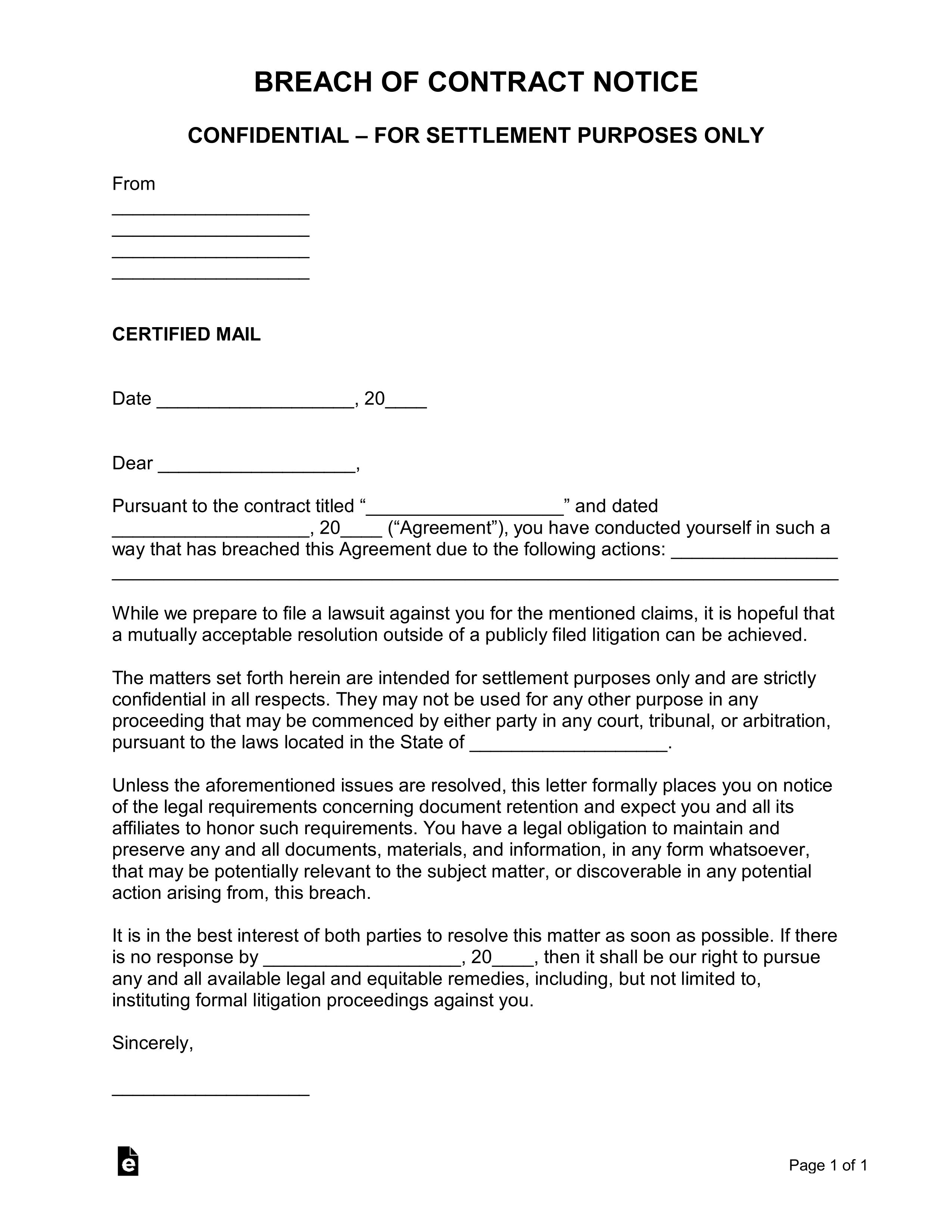

- Violation of Contract

It states the violation of the agreement. It requests the other party to resolve the issue by some compensation or face the consequences. The recipient has to reply to the demand letter before legal action takes place.

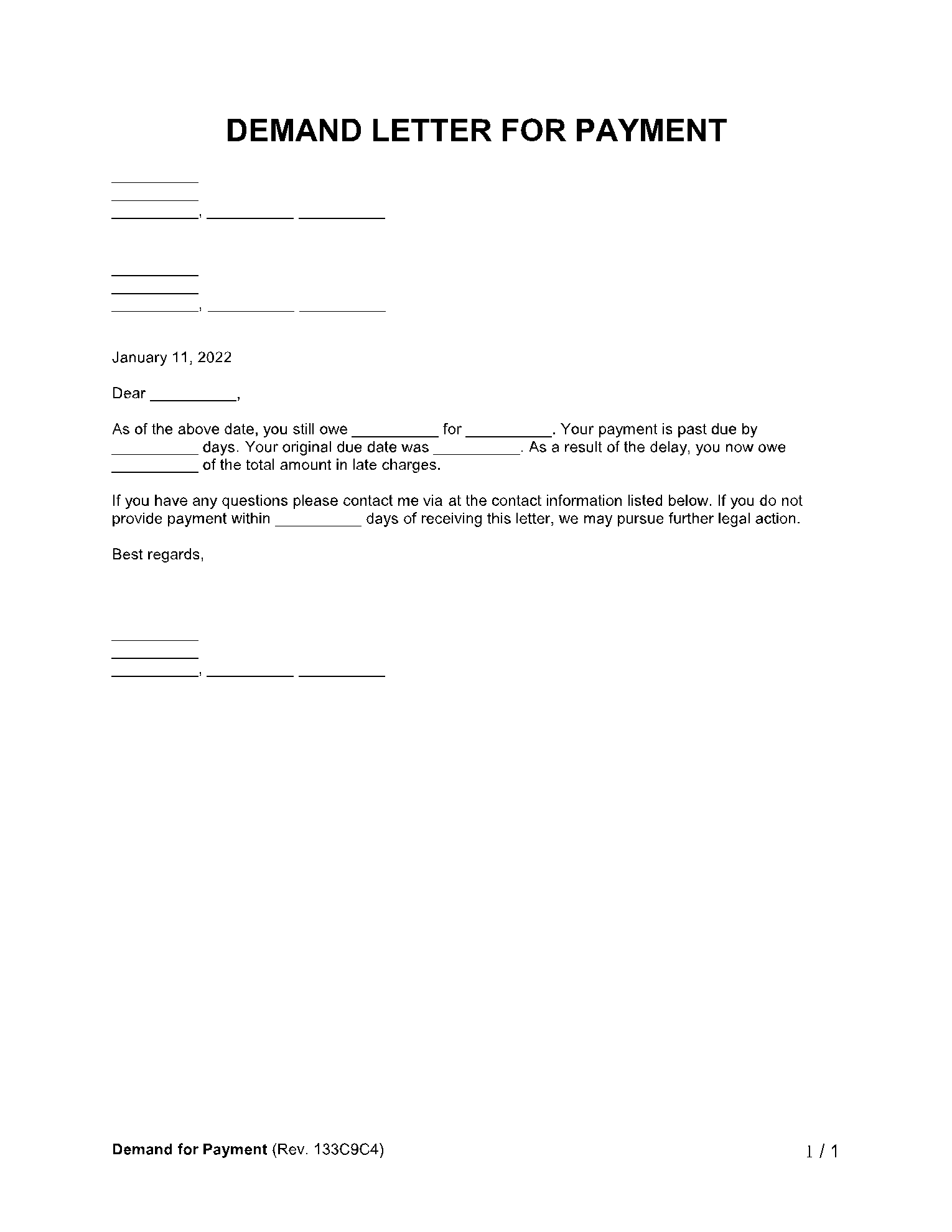

- Remission

This letter is sent to the recipient, including the amount owed by the recipient and reasons along with the deadline as a demand for payment letter. It warns the recipient that if money isn’t paid within due time, legal actions will be taken.

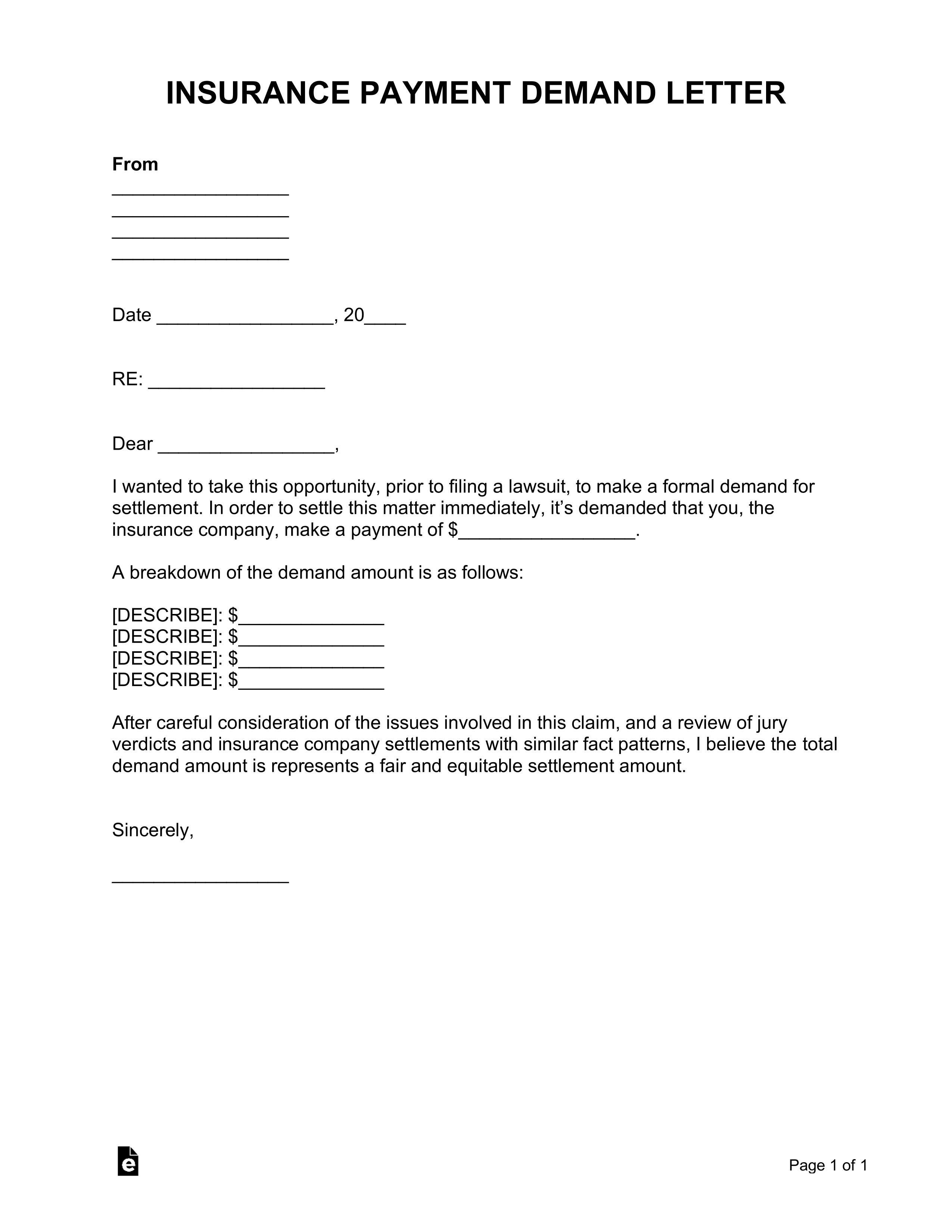

- A Claim of Insurance Money

The insurance demand letter claims money from the insurance company in case of an injury or spoliation of the possessions. The attorney writes this letter to the insurance company to fulfill the demands of the applicant.

- Unpaid Salaries

The employee writes such kind of letter to the employer to claim the unpaid wages. This letter is written in case if the employee has left the company and asks for his/her unpaid dues. It’s also written to claim the overtime payment.

Why Are Demand Letters Important?

A person who deals with legal matters can only understand the importance of a demand letter template. It is written prior to filing a case in court. The reason to send demand letters before taking legal action is to resolve the matter out of the courtroom. It usually occurs where no one is interested in getting involved in long-term cases in court.

The template demonstrates the demands of the claimant in an earlier phase to help the recipient get a clear image of the nature of the sender. The addressees get a clear view of the claims that are brought up against them. It identifies the seriousness of the matter and builds pressure on the addressee to take the business matter wholeheartedly, along with warning them for their actions.

It would seem unethical to file a case against a person or a company without letting them know. Thus, writing a demand letter for payment is observed as a sign of professionalism. This acts as proof against the addressee if something goes wrong and makes your case strong in the eyes of the court.

What Are the Main Elements of a Demand Letter?

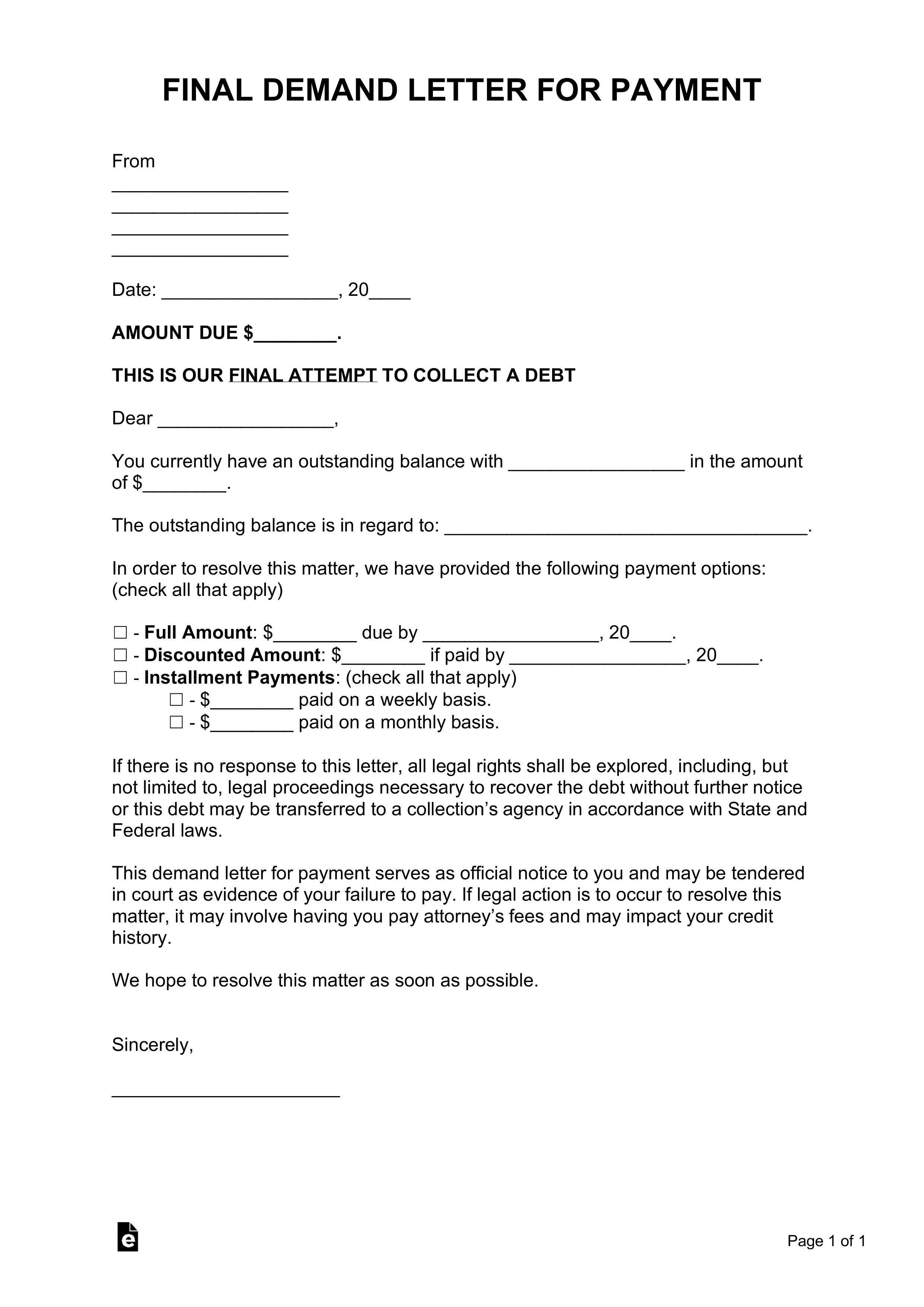

The following information is the main elements that should be included in a demand letter template:

- Participant Information: The complete information of the addresser and addressee, such as the name and the company's name.

- Important Dates: Include the date when the payment got due at first and the last date of payment if the issue is resolved.

- Details of the Dues: Add a complete description of how payment got due and state the reasons for this matter. You may write about the violation of the contract and give a reference from the contract.

- Actions and Consequences: You may mention the required steps to be taken in order to resolve the dispute. You may also indicate about filing a lawsuit as a consequence once the requirements are not fulfilled.

- Signatures of Addresser: Don’t forget to sign your name at the end as proof of intent.

Conclusion

This article provides adequate information about the demand letter. One can take help from a demand letter sample available online to write a letter. It is a sign of professionalism and encouragement for the receiver. The most decent way to claim your money is by using a refund letter in professional language. Disputes can be resolved, and court trials can be ditched if this letter comes out successful.